SFB | Société Financière des Bastions

Gestion de fortune & Family Office

LES ARCHITECTES DE VOTRE PATRIMOINE

La SFB, Société Financière des Bastions SA (ci-après SFB) est une Institution financière suisse, fondée en date du 1 juillet 1989 à Genève, sise dans ses propres locaux, dans le quartier résidentiel de Champel, à proximité du Centre-Ville de Genève.

Totalement indépendante dans ses décisions d’investissement, son seul objectif est d’offrir à ses clients des services « sur mesure » axés sur :

La SFB s’efforce toujours d’identifier des investissements de qualité diversifiés et attractifs à l’échelle mondiale ; pour ce faire, elle dispose d’une recherche interne approfondie, notamment « EIKON (Reuters) », et de contacts privilégiés avec des courtiers/boutiques d’investissement en utilisant les dernières technologies et les outils « fintech » tant en interne qu’à l’extérieur.

En s’appuyant sur son réseau des banques partenaires et des groupes financiers, à la pointe de la modernité, tant en Suisse qu’à l’International, la SFB offre à ses clients un accès privilégié aux principales places financières mondiales.

Notre méthodologie

Description détaillée

Des divers produits financiers et véhicules de placement afin de choisir le profil qui s’adapte le mieux aux objectifs de chaque client.

Construction du portefeuille

Monnaie de référence, devises, type d’investissement, profil risque, volatilité, liquidité, fiscalité et restrictions légales.

Suivi et contrôle

Information régulière et analyse périodique avec le client afin de s’assurer que ses objectifs sont en harmonie avec la gestion effectuée.

Actualités

Tariffs and Pain !

25/06/2025 SFB SAThe world economy is shakier now that Donald J. Trump has been re-elected. The strongly protectionist policies that President Trump ran on, such as a proposed 60% tariff on China, might have an impact on international commerce and macroeconomic conditions both domestically and internationally. A minimum 10 percent duty on all U.S. imports, plus higher tariffs on imports from 57 particular countries, was imposed by an executive order signed by President Trump on April 2, 2025.

Lire la suite

Investment comment Q1 25

30/04/2025 SFB SAThe optimistic prognosis for the economy was upset by US President Donald Trump's trade battles in the first quarter of 2025. Markets experienced volatility as a result of the chaotic U.S. trade and tariff policies that caused a sharp decline in business and consumer confidence, and the major stock indices saw moderate declines. This created fears that corporate earnings growth would be disappointing and that economic growth would significantly slow. Concerns about tariffs caused US stocks to drop, but Europe did better after Germany revealed its spending plans. In the midst of the turmoil elsewhere, gold surged.

Lire la suite

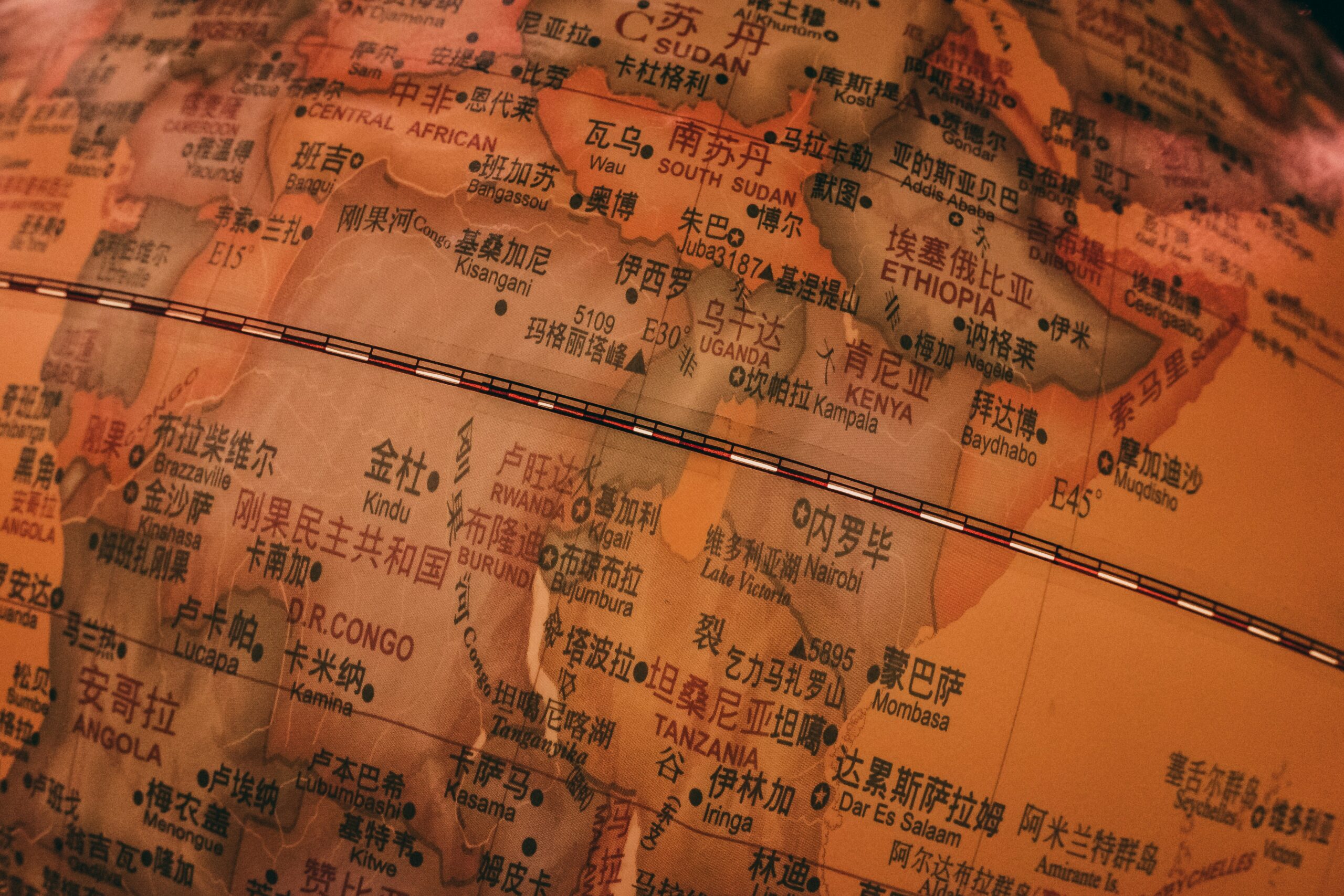

Whose the winner in Africa: India or China?

23/12/2024 SFB SAChina and India, both members of the BRICS, are in competition with one another for the position of global south leader. Beijing and New Delhi, both utilizing their own capabilities that influence international institutions and alliances, are pursuing different but internationally significant agendas as Western dominance dwindles. The decision between China and India to lead the global south is important for African countries, where development and sovereignty in decisionmaking are crucial. Each has benefits and drawbacks that could affect Africa's future.

Lire la suite

Investment comment 12 24

20/12/2024 SFB SAAs the economy remained stable and the Fed continued to lower interest rates, the election results increased hopes for tax cuts and other pro-growth policies in 2025, which helped the S&P 500 to an alltime high in the fourth quarter and extend gains from 2024. For the second consecutive year, the S&P 500 recorded an annual return of more than 20% and a slightly positive return for the fourth quarter.

Lire la suite

Investment view Q2 24

30/07/2024 SFB SADue to the US economy's continued strength and the continued excitement surrounding artificial intelligence, global stock markets saw significant increases in the first quarter 2024. Developed markets had a quiet start to the year, but by the end of January, the US, European, and Japanese equity markets had risen quickly, setting numerous trading records. Given the poor results in both Hong Kong and mainland China, particular attention was paid to the Chinese markets. The idea that the second-biggest economy in the world was having difficulty growing back to pre-pandemic levels was supported by indicators.

Lire la suite

Investment update Q1 24

19/04/2024 SFB SADue to the US economy's continued strength and the continued excitement surrounding artificial intelligence, global stock markets saw significant increases in the first quarter 2024. Developed markets had a quiet start to the year, but by the end of January, the US, European, and Japanese equity markets had risen quickly, setting numerous trading records. Given the poor results in both Hong Kong and mainland China, particular attention was paid to the Chinese markets. The idea that the second-biggest economy in the world was having difficulty growing back to pre-pandemic levels was supported by indicators.

Lire la suite

Investment report Q4 23

30/01/2024 SFB SAThe last quarter of 2023 saw an incredible turnaround in the markets following the declining inflation, strong economic growth, and an unexpectedly dovish Federal Reserve decision. Both equities and bonds mounted a strong rally in the last two months of the year, following a challenging start to the fourth quarter.

Lire la suite

China on fire…

19/09/2023 SFB SAChina, officially the People's Republic of China, is a country in East Asia with over 1.4 billion people and GDP of $27.3 trillion in 2020, the exponential growth of the Chinese economy in recent decades has made it the second-largest economy in the world. China's economy initially grew due to manufacturing, exports, and cheap labour, converting it from an agricultural economy to an industrial one. But over time, a search for new development engines became necessary by an imbalance in growth rate brought on by low returns on investments, an ageing workforce, and diminishing productivity.

Lire la suite

Report 2 Q 2023

31/07/2023 SFB SAGlobal stocks rose in the quarter, with developed markets, particularly the United States, leading the way, while emerging market equities trailed. AI (Artificial Intelligence) enthusiasm has lifted technology stocks. Although the US Federal Reserve chose to remain on hold in June, major central banks boosted interest rates over the time. Government bond rates increased, implying that prices declined.

Lire la suite